Most law firms are set up for the practice of law, not necessarily the practice of billing.

The problem with billing is that it can be time consuming, taking you away from your more pressing matters, like doing the actual work that goes into those bills. Since doing actual legal work is why most lawyers get into the legal profession in the first place, it makes sense to fix your law firm billing process so that you can spend more time lawyering and less time creating bills.

With the right system in place, billing your clients doesn’t need to be painful. In fact it can better support your business by:

- opening up more time to work with clients

- helping you get paid faster

- offering a better client experience that will distinguish your practice from others

For insights on how to set up an effective billing process at a law firm, we spoke with Doug Bend of Bend Law Group, a firm in San Francisco, California with three full-time lawyers and an administrator. Doug’s firm focuses on helping entrepreneurs, advising them on matters such as business transactions, starting companies, raising capital, negotiating contracts, and more.

Here are Doug’s tips:

1. Weigh your billing options

When it comes to setting up a billing process, it’s important to know what factors will ultimately determine the right decision for your firm. From lo-fi to high-tech solutions, two of the most significant factors are likely to be the overall cost of the system and how much time it saves you.

“Gross revenue is important, but what’s most important is net revenue,” said Doug. “Expenses are part of that equation for law firms, and early on, keeping those expenses in check is a good idea.”

Having started his own firm in 2010 after working in a large firm in New York, Doug is familiar with the gamut of billing systems out there.

When Doug first started Bend Law, he used a system of notepads and spreadsheets to track his hours. This involved a lot of manual entry and copying and pasting when it came time to invoice his clients. Logging payments and following up with unpaid accounts became time consuming, especially when dealing with separate ledgers for client funds held in trust.

“About a year in, I recognized that the biggest headache for me was keeping track of my time and invoicing clients,” said Doug.

To save himself some pain, Doug started to look at Clio’s legal billing software as something that could help him keep better track of all his firm’s financial information.

Learn more about your firm’s finances by reading our law firm financial management guide.

2. Consider how much your time is worth

Whether you charge by the hour or by any other alternative fee arrangement, having more time to do actual legal work will ultimately benefit your firm. Since billing tasks can quickly eat away several hours of your time, or the time of your staff, the goal of any billing system should be to streamline workflows and create efficiencies.

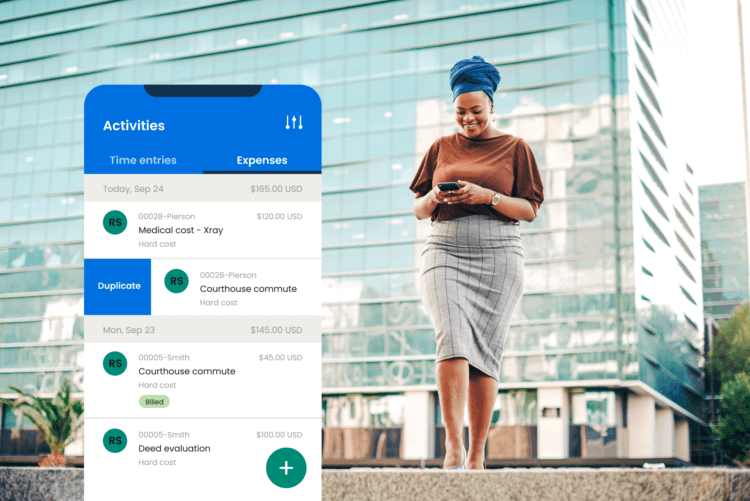

One of the advantages to a system like Clio is that it can automate a significant amount of your firm’s billing tasks, from generating invoices to collecting payments via online credit card processing.

For Doug, the difference in accepting payments by credit card and check had many implications for how to allocate time at his firm. Checks were a major drain on his time. On top of that, there was no way to know if a client had received, let alone acted on, an invoice.

“Sometimes the check would be in the mail, and sometimes it wouldn’t be,” said Doug. “People are busy.”

With the right billing software, he was able to create systems that have helped him save time on many aspects of the billing process at his firm:

- No double data entry. Instead of manually entering his time on each invoice and before sending it out, he now logs his time directly to his billing system which automatically generates invoices for him.

- Electronic invoices and credit card payments. Sending invoices electronically is faster and more convenient than snail mail for Doug. Using this system means he can also share a link for clients to pay him immediately via credit card, which makes them more likely to pay upfront and saves him the effort of following up.

- Client updates without the effort. Clients can pay their bills online without interacting with anyone at Doug’s firm. Once transactions are complete, the invoice and account information updates automatically in Doug’s billing system. It also saves him having to go to the bank to deposit checks or deal with checks that don’t clear.

- Automatic accounting updates. When information is updated in Clio, it’s updated in his accounting software as well, meaning his bookkeeper has all the most up-to-date information she needs at all times.

For more information on selecting the right billing software for your firm, check out our reviews of the best time and billing software.

You may like these posts

3. Know your industry rules

Lawyers work under significant scrutiny—from their clients as much as jurisdictional authorities. It’s important that you ensure any tool you use meets all professional rule requirements.

For example, you’ll want to use a legal billing tool that helps you track payments to avoid the unethical practice of double billing.

Since Doug is based in California, there are strict rules governing how Doug can collect funds into a retainer held in trust: Any processing fees associated with online transactions are required to be paid by the firm as a separate transaction. However, most online credit card services process fees as part of each transaction, which is against the rules.

Using a credit card processor geared specifically towards lawyers can help solve this problem. For example, Doug uses Clio Payments, which ensures that processing fees are deducted from his operating account only. This means that clients don’t see any fees associated with any of their transactions. Instead, Doug’s firm receives an invoice with fees for all transactions completed by his firm that month.

4. Ensure clients get what they want

Building a better billing process isn’t just about efficiency for your law firm: It’s about better client service as well.

Doug’s approach to working with clients comes from his Nebraska upbringing, which is based on being open, honest, and offering the best service he can for the people he’s working with. Part of that involves helping them make the decisions that are in their best interest, but it also involves making everything as easy as possible for them.

When it comes to adopting any type of change to his systems, it’s important that it adds value for his clients. This goes for his billing system as well—many of Doug’s clients are millennials, people in their 30s who are accustomed to operating completely cash free and who prefer to pay by credit card.

“The younger generation, they certainly expect to pay by credit card, and I think clients who are older, they certainly appreciate it,” said Doug. “I think it makes it easier for their bookkeeping as well,” he added. “And, when they’re spending a few thousand on legal fees, getting points for that is a nice benefit that I’m sure they don’t mind.”

Offering his clients the ability to pay their legal fees via credit card allows Doug to better meet their needs, and to make for a better client experience overall. That’s key, because according to the 2017 Legal Trends Report, 62% of consumers find their lawyer via a referral from a friend or family member, and happier clients are more likely to refer you to others.

5. Design a billing process that pays for itself

Time at your law firm is valuable. If you or your staff are spending too much time creating invoices and following up on late payments, that’s time you’re not spending with your clients, and time you’re not billing for.

When weighing out the benefits of his billing system against the cost, the time-savings alone make it worth the expense for Doug.

As he explained, “It came down to putting a value on my time and asking, ‘do I want to be spending time hounding people on their invoices? Or, is it worth my time just to give them an option to pay with a credit card online, and get more of those invoices paid, to open up more of my time for other things?’”

Ask yourself the same question—you may find that revamping your law firm’s billing process with the help of legal billing software may be worth more than you think.

Learn how billing software, combined with an online payment system for lawyers, can help improve the business of your practice.

We published this blog post in April 2018. Last updated: .

Categorized in: Accounting