Should law firms charge clients credit card processing fees? As the demand for online payments increases, many lawyers find themselves facing this question.

We’ve seen discussions in the Law Community and other online forums, but what’s the best option for your firm? More importantly, what is the legal implication of each option?

Law firms need to approach such questions with a client-centered mindset—what would be the best outcome for your clients? What decision would make them feel most valued? It quickly becomes clear that not passing credit card processing fees on to clients is the best choice for them.

In this blog post, we’ll share everything there is to know about credit card surcharges so you can make a final decision for your law firm. Perhaps, you’ll conclude that you’ll surcharge clients. Or maybe, you’ll understand that it’s in the best interest of your clients and your firm to absorb this expense.

What are credit card surcharges?

Surcharging is when a law firm passes on credit card processing fees to the client. The law firm doesn’t absorb the expense—instead, when clients use a credit card, they pay the fee required by payment processing companies.

Surcharges vs. convenience fees

A law firm charges a convenience fee when a client pays with an online payment card—such as credit, debit, or eCheck—rather than a standard payment method like cash or check. Convenience fees are different from surcharges, which is a charge that only applies to credit cards.

Is it legal for law firms to add a credit card surcharge?

Surcharges are legal in some states but not all. It’s important that you do your research to ensure your jurisdiction allows credit card surcharges.

Credit card surcharge rules for law firms

What does it mean to pass along credit card processing fees to clients? Law firms need to consider several things:

Ethics opinions on lawyers accepting credit cards

Some lawyers don’t accept credit cards because they have many use cases—and not every state ethics committee has addressed these issues. Because of this, lawyers need to consider how they are using credit cards before accepting them, and how they will handle processing fees.

In general, there are four ethical questions surrounding credit cards for law firms:

- Can I accept payment for legal fees and expenses via a credit card?

- Can I accept the advance payment of fees via a credit card?

- Can I pass a surcharge to my client to compensate for the processing fees charged by some credit card processors?

- Can I set up recurring charges for customers once they have stored a credit card on file with my law firm?

In addition to these considerations, lawyers must also ensure that their state permits them to accept credit cards. There are also ten states with ethical opinions forbidding passing credit card surcharges to clients—we’ll discuss this next.

What states don’t allow law firms to apply credit card surcharges?

- As we mentioned, credit card surcharges are not always legal. Some states prohibit surcharges. Here are some examples of state regulations that prohibit surcharges on credit cards and/or debit cards.

- Connecticut: § 42-133ff. Surcharge based on method of payment prohibited. Acceptance of bank credit card bearing a trade name. Discount not prohibited. Contracts not to prohibit discounts based on method of payment for gasoline. Minimum purchase policy. Purchase of travel services using a credit card (General Statutes of Connecticut (2023 Edition))

- Maine: ME Rev. Stat. Tit. 9-A Sec. 8-509 Credit card and debit card surcharge prohibition (Maine Revised Statutes (2023 Edition))

- Massachusetts: Mass. Gen. Laws Ch. 140D, Sec. 28A Cardholder discounts; surcharges; finance charge (The General Laws of Massachusetts (2023 Edition))

- Puerto Rico: 10 L.P.R.A. § 11 Prohibition on surcharge for credit card use (Laws of Puerto Rico (2023 Edition))

Other states may have regulations that permit surcharges but impose limitations on the amount of a surcharge. These states include:

- Colorado: Caps credit card surcharges at 2% of the total payment made for goods or services purchased with no surcharge allowed on debit cards, (Colo. Rev. Stat. § 5-2-212 Surcharges on credit transactions – enforcement – definitions (Colorado Revised Statutes (2023 Edition))

- Minnesota: Caps surcharges at 5% of the purchase price, (Minn. Stat. 325G.051 Surcharges On Credit Cards (Minnesota Statutes (2023 Edition))

- New York: The credit card surcharge cannot exceed the amount charged by the credit card company (NYS GBS Law § 518 Credit card surcharge notice requirement (The Laws of New York (2024 Edition))

If you practice law in any of these states, it may be illegal for you to add certain surcharge fees to clients. Always review your state’s regulations on surcharges, as details vary by state. For example, New York lawyers can charge clients a credit card surcharge but they must clearly display the total price, including the surcharge amount (which must be reasonable and cannot exceed the amount charged to the firm by the credit card company) before accepting payment. These restrictions do not apply to debit card purchases in New York.

Other states may have similar surcharge prohibitions on the books but require a review of any appropriate case law. Some states have narrowed the enforcement scope of these regulations due to First Amendment challenges to these regulations.

Compliance with credit cards beyond ethics opinions

Aside from ethical issues, compliance with credit cards is another deterrent from accepting online credit cards. Law firms accepting credit cards must comply with the Payment Card Industry (PCI) standards by major processors. If your law firm accepts credit card payments, there are five compliance goals you’re encouraged to reach:

- Build and maintain a secure network

- Protect cardholder data

- Maintain a vulnerability management program

- Implement strong access control measures

- Maintain an information security policy

You may like these posts

Other considerations regarding credit card surcharges for law firms

Rules for prepaid or debit cards

Some credit card networks do not allow merchants to charge surcharges for debit card transactions. You can’t necessarily control or know beforehand what your client will use to pay. They may use a debit card. Do not expect to be able to apply a surcharge to every transaction.

Rules for VISA, Mastercard, American Express, and Discover cards

If you’re considering credit card surcharging, in addition to ensuring it’s legal in your state, you must determine which cards your firm will accept and which credit card processing software you will use. Each credit card brand has its own set of rules and guidelines for merchants who surcharge clients.

The general guidelines for each payment processor are:

- Notify the card networks and payments solution provider. You must give the credit card provider 30 days’ notice that you intend to surcharge clients.

- The surcharge must not exceed your cost of acceptance for the credit card. This guideline means you cannot profit from surcharges—you can only charge the processing fee.

- Communicate surcharging clearly to clients. Clients must know your credit card surcharging policy beforehand.

- Record all credit card surcharges accurately. You need detailed invoices, and you need to indicate the final surcharge amount clearly.

Benefits of not implementing credit card surcharges

While it might seem appealing to implement credit card surcharges, there are many benefits to absorbing the cost.

Provide a better client-centered experience

Being client-centered extends to every aspect of your practice, including payments. With 66% of clients expecting law firms to pay online, adding surcharges can cause friction, making it more difficult for clients to pay the way they want.

Imagine you’re at a local bakery, and you pay with a credit card. The shop tells you you’ll have to pay an additional fee just because of your payment method—how would you feel?

Improve collections by getting paid faster

Credit card surcharges make it harder for legal clients to pay you promptly. The fees can be a turn-off for clients. In addition, the fees may also result in the slow (and long process) of the client going to the bank, then dropping off either a check or cash to your office.

If you don’t implement credit card surcharges, you need to follow fewer restrictions and processes—making it easy for clients to pay. When you make it easy for clients to pay, you will more likely get paid faster. This alone offsets surcharging.

Increase cash flow

Getting paid faster means you’ll most likely improve your firm’s collection rates. Ultimately, your cash flow will likely increase. An improved law firm cash flow enables you to have the funds to settle any debts, reinvest in your business, and more.

For more tips on surcharges and online payments for lawyers, visit our payments resource hub.

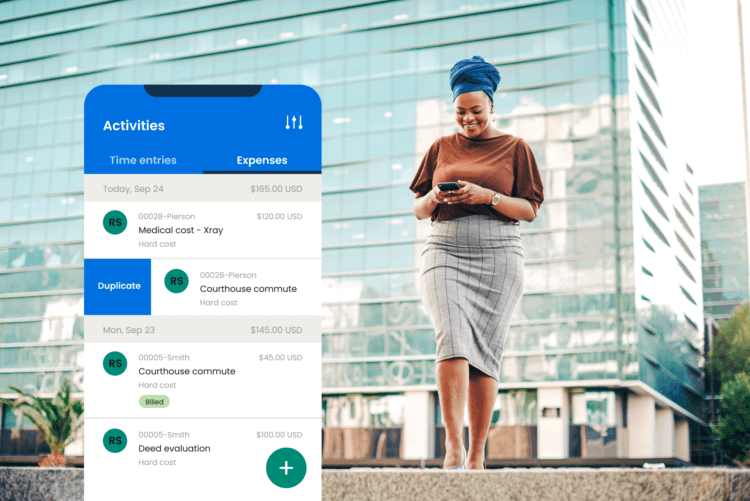

An alternative to credit card surcharges: eChecks with Clio Payments

Let’s say absorbing credit card processing fees aren’t an option for your firm, but you also understand the benefits of not surcharging. Accepting eChecks with Clio Payments is a great option at 1% per transaction and no hidden fees. Implementing this online payment method means you can provide a client-centered payment experience that also benefits your law firm business. This method makes payments frictionless and gives you the freedom to implement payment plans and automated payments.

Focus on providing a client-centered experience

The process of credit card surcharging is complicated, and in some states, even illegal. There are many rules and compliance regulations when surcharging, and it’s not always in the best interest of your clients or business to impose this charge. By absorbing this expense, law firms practice a client-centered mindset and helping their business—by increasing cash flow and improving collection rates.

If your firm cannot absorb credit card processing fees, looking for a payment solution that offers eChecks, like Clio Payments, is a great alternative.

You can learn more about Clio Payments.

We published this blog post in November 2021. Last updated: .

Categorized in: Business

Get paid faster, save time, and reduce outstanding bills

Download our free e-book and learn the 7 easy steps to easier, more efficent billing

Get the e-book