As a trusted legal professional, it’s important to understand Interest on Lawyer Trust Accounts (IOLTA) and how this is handled.

Law firms need to follow specific rules on how client funds are handled, and maintaining an IOLTA account ensures compliance with ethical and legal obligations.

Read on to learn about their inner workings, why society and the legal industry at large benefit from IOLTA accounts, and many other trust accounting tidbits.

Understanding IOLTA accounts

IOLTA stands for Interest on Lawyers' Trust Accounts. This type of trust account is used by lawyers to responsibly hold client funds.

What is an IOLTA account?

Lawyers may need to hold funds for retainers, settlement proceeds, and court-awarded damages, among other reasons. Using an IOLTA account ensures any interest earned is remitted to state bar associations, which are donated to support legal aid programs and other public service initiatives.

What is an IOLTA account used for?

Additionally, interest from earnings in these accounts helps fund improvements in legal representation and social justice initiatives that strengthen communities across the country.

How does IOLTA benefit lawyers and clients

IOLTA offers advantages to both lawyers and clients alike.

For lawyers, these accounts ensure compliance with ethical rules regarding the safekeeping of client funds while also reducing the administrative burden of managing multiple individual accounts.

Clients benefit from IOLTA as they gain peace of mind in knowing their funds are held in a secure place. Moreover, the interest generated is pooled to support legal aid programs—allowing them to indirectly contribute to ensuring equitable access to justice for all.

You may like these posts

The history of IOLTA accounts

Today, the National Association of IOLTA (NAIP) shares that “there are IOLTA programs throughout the United States, including all fifty states, the District of Columbia, Puerto Rico, and the Virgin Islands.”

However, this wasn’t always the case.

Bar associations had to petition vigorously to establish the first IOLTA program in the United States. See the below points to learn about the roots and growth of IOLTA in the country, sourced from the American Bar Association’s (ABA) overview of IOLTA:

- Beginning in 1978, the ABA provided information on the development of American and foreign IOLTA programs to interested bar associations, legal services providers, and states.

- Federal banking laws passed by US Congress in the 1980s allowed some checking accounts to bear interest.

- In 1981, the ABA formed the Advisory Board and Task Force on Interest on Lawyer Trust Accounts, which reported to the ABA Board of Governors in 1982.

- In 1982, the ABA Standing Committee on Ethics and Professional Responsibility issued an opinion that examined the ethical implications of a lawyer’s participation in an IOLTA program. The opinion concluded that it is ethically permissible for a lawyer to participate in an IOLTA program authorized by a state. See ABA Formal Opinion 348 (July 23, 1982).

- To support the initiation and operation of IOLTA programs, the ABA created the Commission on IOLTA in 1986.

- Since 1981, IOLTA has generated over $4 billion in revenue throughout the United States—providing a significant source of funding for programs that provide civil legal services to those in need, with over 90 percent of grants awarded by IOLTA programs (~$168 million in 2020) supporting legal aid offices and pro bono programs.

Does my state have an IOLTA program?

While IOLTA isn’t mandatory in all states, as mentioned above, all 50 states do have an IOLTA program. Take a look at the ABA Directory of IOLTA Programs to find your state’s information.

It’s important to understand that different states will have different IOLTA requirements. We recommend checking in with your bar association and state program to understand geographic-specific compliance.

That said, most jurisdictions require law firms to address three primary areas to comply with IOLTA regulations when managing client funds:

- Account identification: Law firms must deposit funds into an account specifically labeled as a trust/client account.

- Segregation of accounts: Law firms must keep client funds separate from a lawyer’s own funds.

- Accounting records: Law firms must create and maintain appropriate records of funds belonging to their clients.

Getting started with IOLTA accounting

Working with an accountant and the right legal practice management software will ensure you have accurate record-keeping—and help avoid the nightmare situation of malpractice.

As with general trust accounting, IOLTA presents malpractice traps, such as:

- The commingling of funds

- Charging fees for processing online payments

- Borrowing IOLTA funds to cover operating expenses

These mistakes can impact even the most diligent lawyers. After all, as the attorney, you’re the one on the hook for misusing funds from an IOLTA, even if it’s made by a bookkeeper or paralegal. Many malpractice claims also arise from minor human errors, including missed deadlines and miscommunication.

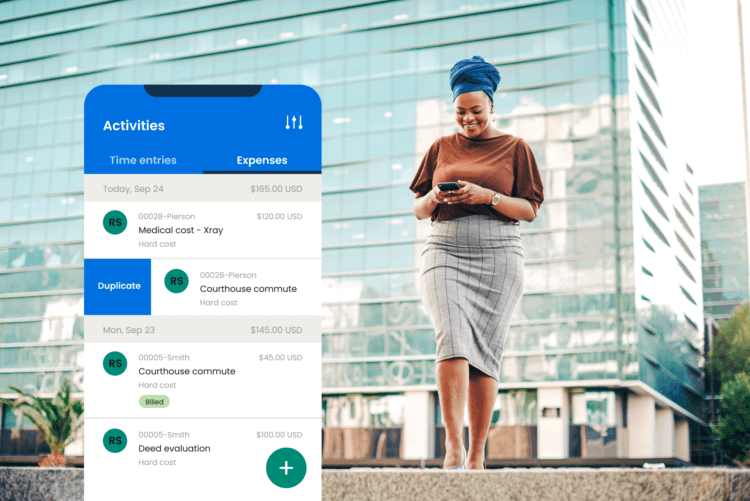

The good news is this can be alleviated by using sophisticated legal practice management software. Clio’s legal trust accounting management software makes IOLTA easy for lawyers. You get peace of mind knowing you’re compliant and your clients get the best version of you working on their case. Everyone wins.

Already a Clio user? This is how to use the trust accounting features for IOLTA.

Choosing the right IOLTA provider

While IOLTA is widely recognized and practiced across the US, and other countries, there are differences at the state level. Make sure you verify what rules apply to your law firm with your state bar association.

With that said, most jurisdictions require law firms to address three primary areas when managing client funds:

- Account identification: Law firms must deposit funds into an account specifically labeled as a trust/client account.

- Segregation of accounts: Law firms must keep client funds separate from a lawyer’s own funds.

- Accounting records: Law firms must create and maintain appropriate records of funds belonging to their clients.

While it may seem simple on paper, the reality is that maintaining a compliant and ethical IOLTA account can be incredibly complex and time-consuming, especially without the proper tech stack. The strict state-specific rules and accounting intricacies can be a malpractice trip wire for the most experienced lawyers. After all, even big law firms with dedicated accounting teams have specific processes to maintain IOLTA compliance.

Smaller law firms and solo attorneys have more pressure to be diligent—just the slightest mistake can have career-limiting consequences.

Thankfully, these challenges can be alleviated with the right legal trust accounting management software. When selecting a provider, look out for features like:

- Thorough record-keeping capabilities for trust accounts

- Strict adherence to industry regulations

- Robust security features that protect client confidentiality

- Seamless integration with third-party accounting tools

Clio’s legal trust accounting management software makes IOLTA easy for lawyers, helping meet the above requirements with trust accounting features and workflows. The result? Lawyers sleep soundly knowing they’re compliant and can confidently continue to help their clients.

Clio Payments removed any hesitancy I had around accepting online payments, especially surrounding IOLTA accounts. – Casey J. Lee, CJL Law

Final notes on interest on lawyer trust accounts

The IOLTA system can have tremendous benefits for society at large. Think of all the good you can help support by simply by simply ensuring your trust accounts are handled effectively?

With that said, ensuring adherence to the IOLTA principles on your own can be stressful and risky. Be sure to work with a trusted accountant with experience working with lawyers, and do yourself and your firm a favor: Invest in legal trust accounting management software. (Want to see Clio’s trust accounting features in action? Book a demo today.)

What is the purpose of an IOLTA account?

IOLTA Account holds client funds that are either too small in amount or held for too short a period to generate interest for clients. The interest earned on these pooled funds is used for civil legal aid programs, assisting those who cannot afford legal representation.

How can I reconcile and track IOLTA transactions?

To effectively reconcile and track IOLTA transactions, it’s essential to maintain meticulous records, regularly compare bank statements with internal records, and conduct periodic audits to ensure compliance with regulations and ethical standards.

Where can I find additional information on IOLTA?

Additional resources and guidance for IOLTA are available through the American Bar Association and local state bars. When managing IOLTA accounts, be sure to always seek expert advice and partner with legal technology companies that prioritize stringent compliance with industry regulations.

We published this blog post in May 2024. Last updated: .

Categorized in: Accounting