Managing cash flow at your law firm is already a challenging task under normal circumstances. This makes the need for good cash flow management particularly important—and even more difficult—during an economic downturn. With demand for legal services dropping, the challenge of managing your firm’s cash flow can take a personal toll on you, on top of the many personal challenges you and your staff may already be facing.

The key is to accept that even though things won’t be perfect, you can focus on doing your best to adapt to the fast-moving variables of law firm economics. In this blog post, we’ll go over what steps you can take right now to improve your law firm’s cash flow, and what to do if your law firm is experiencing cash flow problems.

How to improve your law firm’s cash flow

Audit your current cash flow

Before you can take steps to improve your cash flow, you need to understand the current cash flow of your law firm by creating a cash flow forecast. This article expands on how you can create a cash flow projection. This projection should be updated regularly to accurately reflect your law firm’s cash flow.

Gale Kirsopp of 4700Group put together a succinct one-pager with everything you should consider when looking at your law firm cash flow.

You may like these posts

Accept online payments like credit cards

If you aren’t accepting online payments yet, we recommend switching the way you accept payments or providing your clients with an option to pay with credit cards. During a crisis like COVID-19, paying by check or other non-electronic methods can be harder or simply impossible to do. By offering an easier way for your clients to pay, you can make the legal experience a lot less stressful for your clients, and also increase the likelihood that they pay on time.

Law firms who accept credit cards get paid faster—according to our 2019 Legal Trends Report, 57% get paid within the same day they bill their clients, and 85% get paid within a week. Credit card payments are convenient for clients and they’re also easy to set up and track, which means your law firm can increase client satisfaction while spending less time on administrative tasks.

Before you start accepting online credit card payments, be sure to pick the right credit card processing service for your law firm. Ensure your chosen provider will help you stay compliant with ethics rules for trust accounting, and check on pricing, monthly and per-transaction fees, and how the credit card processor works with your firm’s workflow.

Bill clients by using evergreen retainers to protect cash flow

Evergreen retainers are beneficial for your law firm and your clients, as they increase your law firm’s cash flow and collection rate, and can help streamline accounting at your law firm. Your clients can pay in stages instead of a lump sum, and replenish the amount once the retainer hits a predetermined minimum balance. This way, there will always be enough funds for your client to make a payment.

If you already use evergreen retainers: Clio customer Erin Levine suggested on Episode 2 of Clio’s Daily Matters Podcast to consider asking your clients to top up their retainers sooner than you normally would to protect cash flow at your firm. Although many clients may be facing financial difficulties of their own, you won’t know what’s possible until you ask. You also may be surprised at the answer.

Optimize overdue accounts receivables

Following up on unpaid invoices is often a laborious and daunting task. If you’re feeling uncomfortable about having to chase clients for payment during a crisis, that’s understandable. You may be worried about affecting your client relationships negatively. However, you can take the opportunity to take a client-centered approach, by offering clear options that work for both your clients and your firm.

The first step to optimizing your accounts receivables is to ensure you have a clear and enforceable accounts receivable management process.

If you find yourself with overdue invoices, take action as soon as possible by sending gentle reminders by email. If reminder emails don’t seem to be working, a phone call may be necessary.

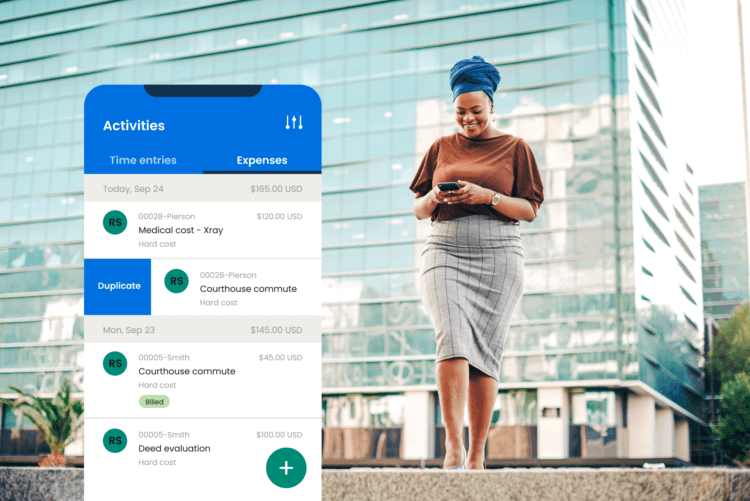

Legal billing software like Clio can help automate parts of the collection process and save your staff time. A tool like InvoiceSherpa gives you back your time by sending automated reminders via email or text message when a due date is coming up, or when a bill is past-due.

InvoiceSherpa also automatically sends a thank you message after a client pays their bill, which is a nice customer service touch. Instead of waiting on slow-paying clients or chasing clients down for payments, a tool like Fundbox can help your law firm receive money sooner to help with cash flow.

Offer your clients payment plans

Take the opportunity to offer a client-centered experience by providing a payment plan option that works best for your clients—while ensuring that the payment plan works for your law firm. To do this, create an internal protocol for when to offer clients payment plans and what payment plans to offer, draft an agreement template, and set up a system for billing clients and collecting funds. This blog post explains how to implement payment plans at your law firm further.

Improve productivity with the right technology

According to our 2019 Legal Trends Report, the average lawyer spent only 2.5 hours on billable work each day. This means the rest of the day is spent on administrative tasks that don’t bring in revenue. And this is a critical issue if your firm bills by the hour. Use the right technology to boost productivity per lawyer, and you’ll increase revenues for your firm.

The right technology can help your firm save time by automating time-consuming day-to-day tasks like client intake, document, matter, and contact management, time and expense tracking, and more. To choose the right technology for your law firm, you need to be clear about the problems you’re looking to solve. This article on law firm tech expands further on what technology your law firm needs. And, while it may be tempting to cut costs on technology, think critically about the pros and cons of using cheap or free case management technology at your law firm.

What to do if your law firm is experiencing cash flow problems

Reduce fixed and variable costs

Reducing costs can be a tedious process. However, this should be the first step to improving cash flow during a recession.

Negotiate with service providers. Try contacting your phone, internet, and other service providers to negotiate a better price. Service providers tend to have measures in place to help customers in need during a crisis, and you won’t know what help is available unless you ask. Some may be willing to defer payments or provide a few months of service at a reduced rate (or no charge) if it means keeping your law firm in business and keeping you as a customer long term.

Also, if you aren’t already paying a fixed amount for utilities every month, contact your service provider and ask to switch to a fixed monthly payment structure. This helps reduce uncertainty in times of crisis.

Make cuts where you need to. Tools that maintain business continuity and cash flow are essential during a crisis—like practice management software, or online payments and collection—and should be the last thing to consider cutting. However, if law firm cash flow is a problem, it’s time to take a look at any extras. When you decide what costs to cut, communicate clearly and early with your service providers to maintain a good relationship with them. You never know when you’ll need their help again.

Sell non-essential assets

As its name suggests, non-essential assets are anything that won’t impact your law firm’s business operations—from equipment to real estate. Every law firm will have a different definition of what’s considered non-essential. Perhaps your firm has extra office space or office machines that no one uses. Selling these non-core assets can help you raise cash relatively quickly.

Apply for available funds

Check if your federal government has announced an economic stimulus package to help businesses and individuals navigate the challenges of a financial crisis. An economic stimulus package may include emergency and forgivable loans. It may also include bill deferments to help businesses with payroll costs, mortgage interest, and utilities.

For example, as a response to COVID-19, the US launched the Paycheck Protection Program. They also added a grant element to the Economic Injury Disaster Loans it usually provides to small businesses in times of crisis. You can learn more about these programs here.

Federal economic response plans are focused on helping businesses keep their workers, access credit, defer taxes, and more. Your local government may also have a program to help businesses in need during a crisis.

Apply for a line of credit

Consider a line of credit as a backup plan for your law firm—even if you don’t need it yet. A line of credit loan gives you additional financial cushion. It also tends to have a higher credit limit and lower interest rate compared to credit cards. You are only required to pay interest on what you use. This means you don’t have to worry about incurring interest if you don’t use the line of credit.

Try looking into online financing companies, or lenders who offer online applications and quick decision making. This can drastically affect how soon your law firm can access a line of credit.

If you’re also applying for government stimulus funding: Check if there’s a restriction on accessing other sources of credit. Terms on government loans may be more favourable for your business than private lender loans. Be sure to familiarize yourself with the available options before you apply.

Negotiate with creditors

You’re not alone if this seems like yet another overwhelming undertaking as a law firm business owner. However, negotiating with creditors is essential, especially during a crisis. If you’re facing cash flow difficulties, it’s important to communicate that with every creditor. Try requesting a lower interest rate, a higher credit line, or changing your payment options. A respectful and positive tone will also go a long way.

Last resort: Reducing hours for staff and contractors

When business owners run into cash flow problems during a global financial crisis, one of the first questions they ask is, “Should I let go of some of my employees?” This an uncomfortable question. The thought of having to let go of staff members you genuinely care about is also incredibly difficult. But when you’re worried about being able to pay rent, the harsh reality of having to lay off staff becomes too real.

Gideon Grunfeld of Rainmaking For Lawyers suggests that law firms consider “reducing hours for employees and independent contractors instead of laying them off or starting a furlough.” Letting go of your law firm’s staff should be a last resort.

How to decide if you should lay off some staff members: The decision is subjective to each law firm business owner, but this Harvard Business Review article has some helpful tips for businesses facing the difficult situation of laying off employees, including making sure you carefully consider if there are other ways your firm can protect as many jobs as possible, not overpromising when offering assistance to employees, and showing compassion.

Henry Ward, CEO of Carta—an equity management solutions company—exemplifies that much-needed compassion in this heartfelt and moving article where he shares his company-wide layoff announcement. He illustrates his deep gratitude towards all his employees: “I am privileged to have worked with all of you. Thank you for having been a part of our company. Thank you for being a part of our lives … We are all better for it.”

Take care of your mental health

Dealing with cash flow problems as a law firm business owner is incredibly stressful and overwhelming, and can dramatically affect your mental health. Remember to be kind to yourself. Simple activities like taking deep breaths, stretching, eating healthy can go a long way in helping you cope better with stress.

You may feel you can only spare a few minutes a day. Still, take that time to try meditating, exercising regularly, or doing things you enjoy. Encourage your staff to do the same as best you can. And, connect with them regularly to help support them through the stressful period.

Conclusion and additional resources on law firm cash flow

Law firm cash flow management may seem overwhelming, especially in a crisis like a global recession. However, we hope the steps we’ve outlined above will help you tackle the challenge of improving your cash flow. From tightening expenses where possible, to applying for available funding and credit, you have options.

Improving cash flow during a crisis is a complex challenge. To help, we’ve added some additional resources that we hope will be helpful for your law firm:

We chatted with T.C. Whittaker, the Law Firm Solutions Leader at PwC InsightsOfficer on Episode 12 of our Daily Matters podcast, where he discussed how law firms can understand their cash flow needs to keep money flowing into the business, and how important it is for legal professionals to innovate and adopt an entrepreneurial mindset to emerge from a crisis successfully.

Know that you are not alone in times of a crisis. The burden from facing law firm cash flow issues can weigh heavily on business owners. However, we hope these tactics will help you through whatever troubles you’re facing.

Note: The information in this article applies only to US practices. This post is provided for informational purposes only. It does not constitute legal, business, or accounting advice.

We published this blog post in April 2020. Last updated: .

Categorized in: Accounting, Business