If you’ve noticed more “buy now, pay later” options at checkout, you’re not alone. This financing method is taking the world by storm, with consumers using it for everything from big-ticket purchases like exercise equipment to necessities such as groceries and rent. Unsurprisingly, legal services are also experiencing a rise in buy now, pay later requests.

Buy now, pay later—or legal fee financing, as it’s commonly called—is one of several alternative payment methods offered through law firms. By easing the burden of large, one-time bills, it’s making legal services more accessible to those who need it most. Rather than risk having legal needs go unmet, client-centered law firms are allowing legal services to be paid through installments. This represents a growing shift toward not only focusing on what legal services are offered, but also, how they’re provided.

Aside from offering clients flexibility, legal fee financing also benefits law firms thanks to its ability to attract a more diverse client base and promote effortless payments. Read on as we explore which alternative payment methods are best for your clients and your law firm.

What is legal fee financing?

Let’s take a deeper dive into what legal fee financing is. In a nutshell, legal fee financing is an alternative funding solution allowing clients to pay for their legal costs in regular intervals (typically monthly) instead of one lump-sum payment. In short: the law firm will receive the full amount up front, and the client will pay a third-party creditor in installments. Clients may be able to obtain a loan from a traditional financial institution in some instances or through a third party. If you’re interested in learning more, the American Bar Association released guidance on how law firms can help clients who use financing for legal services.

The biggest benefit of legal fee financing is that it helps law firms get paid faster. However, it’s worth noting there are additional ways to improve cash flow in your law firm—such as payment plans.

Legal fee financing vs. payment plans: What’s the difference?

When it comes to paying legal fees, clients want options. Clio’s 2022 Legal Trends Report found that payment plans are among the top factors in hiring a law firm, with multiple billing options receiving the fourth-highest impact score for law firm hireability. Although there’s no question that choice is a positive thing, some payment methods are better than others.

Legal fee financing

Legal fee financing helps firms grow their client base while delivering the flexibility clients need. But on closer examination, there are pitfalls—chief among them cost. Missing a payment might burden a client with interest. This can increase their legal payments at best and spiral them into debt or collections at worst.

It’s not just clients who experience downsides, either. Legal fee financing often comes with monthly processing fees. Conversely, Clio Payments offers simple and transparent pricing.

Payment plans

Payment plans allow clients to pay through a suite of options, such as subscription models, that don’t charge additional fees in exchange for the flexibility gained. They typically involve an agreed-upon amount that clients pay on a regular basis toward their balance. But unlike legal fee financing, firms have the flexibility to charge zero interest and set their own terms. At Clio, we refer to our payment plans as “alternative fee arrangements.”

It goes without saying that payment plans are a much more client-centric solution. They allow clients to pay large bills through a cadence that works for them and their law firm. And with the right legal software, you can automate payment plans and avoid additional steps or overhead.

You may like these posts

Why should you offer alternative payment plans for your law firm?

When it comes to alternative payments, the advantages of some options outweigh others. Ultimately, the best choice depends on the law firm and what works for its unique needs. No matter which option you choose, your clients benefit—and so do you. So, what are some key reasons to integrate alternative payment plans in your law firm?

For one, it makes getting paid significantly easier. Law firms with well-off clients and businesses usually have their invoices paid in full and on time—which is great. But legal fees can be a hefty investment for some clients, especially during mounting inflation and rising interest rates. Not everyone has the means to pay for legal services outright. Breaking payments into more manageable installments results in more consistent income for your firm.

As payment plans give clients the convenience to pay in a way that suits them, offering alternative fee arrangements can set you apart from other law firms and, ultimately, attract more clients. In fact, Clio’s 2022 Legal Trends Report found that most clients want a range of options: 70% want the option to pay via a payment plan, 65% want the option of legal insurance, and 53% want the opportunity to crowdfund their legal bills. The more choice you offer, the more diversified your client base will become.

Benefits of alternative fee financing

There are many perks of providing alternative fee financing for your clients. By offering this flexibility, you can:

Maintain positive, client-centered relationships

Providing payment options empowers you to focus more on helping your clients with their ongoing legal matters. This flexibility is essential for relationship building as clients will appreciate the mutual trust and respect that comes with payment plans. When they’re happy, there’s a good chance that they’ll let other potential clients know about it, too.

Increase collections

The average law firm collects only $748 for every $1,000 of billable work, according to Clio’s Legal Trends Report. With alternative fee financing, you can collect more outstanding balances by allowing clients to break large bills into manageable installments. Over time, this can add up to significant cash flow each month.

Save time

Late payments can place a heavy burden on a firm. And if there’s one thing lawyers need more of, it’s time. Since lawyers complete only 2.6 hours of billable work each day, every effort needs to be made to become more productive. Flexible payments reduce the likelihood of having to devote a large chunk of time each month to following up on late payments.

Diversify your client base

Clients are key to your success whether you’re a solo practitioner or a small law firm. Diversification of your client base is equally critical. As you’ve no doubt experienced, people leave roles, needs evolve, mergers happen, and companies go out of business, which is why you shouldn’t put all of your eggs in one basket. When you offer multiple options for payment, you open the door to more clients and expand your reach. Providing diverse options ultimately translates into increased revenue for your firm.

How to implement payment plans at your firm

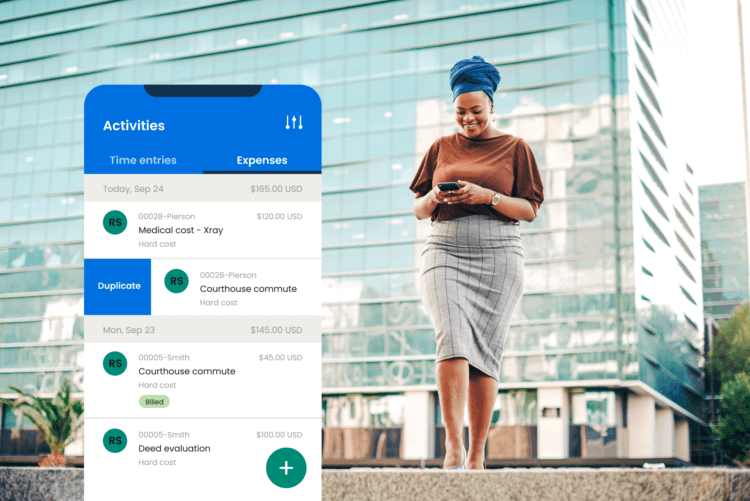

Payment plans are simple to manage and execute when using the right legal software. For instance, online payment solutions like Clio Payments make it easy to offer various billing options. You can also set up and track automated payment plans for customer bills or retainer deposits and top-ups.

Below are a few specific payment features that will improve the process of implementing legal fee financing for your law firm.

- Seamless invoicing: The best software solutions allow you to create invoices in a few easy clicks—and get paid through Pay Now buttons in your electronic bills, along with QR codes, secure click-to-pay links embedded in emails, or over the phone.

- Integrated financial reporting: When a transaction is made, leading payment solutions will automatically post it to the appropriate matter or client account and sync records with your accounting platform. So you can rest assured that your information is always up to date.

- Flexible online payments: It’s also important to make it easier than ever for clients by offering the option to pay using any device through credit card, debit, or eCheck.

Along with checking the boxes above, Clio manages the entire legal client journey through one secure, compliant, and trusted system. This spans from the very beginning of client intake, all the way through payment collection.

Putting it all together

Flexible payments don’t just help your clients—they can also make a world of difference within your law firm. With flexible payments, you’ll see a jump in revenue while bringing in more consistent revenue. What’s more, you’ll make a difference in the lives of clients who can’t otherwise afford your legal services.

We published this blog post in October 2022. Last updated: .

Categorized in: Accounting, Business