It’s a classic challenge: Legal clients want options when it comes to paying their legal bills, and law firms want to get paid. Fortunately, alternative payment methods like recurring payments can help everyone meet their needs.

By offering recurring payment plans, law firms make it more manageable for clients to pay their legal bills in regular installments instead of one large sum. This means clients can more easily afford legal services while having a better client experience. And, when clients are more likely to pay their bills in a predictable manner, law firms can spend less time on payment collection while enjoying improved cash flow.

It’s a win-win.

Read on to learn more about recurring payments for law firms, including the key advantages of offering recurring billing options—for your firm and for your clients. We’ll also explain how you can easily set up recurring payments with Clio Payments.

What are recurring payments?

Also known as “subscription payments,” recurring payments for law firms occur when a client agrees to set up a subscription with a law firm. With this recurring payment, the client is then automatically charged (typically via credit card payment) a certain amount at a particular predetermined interval.

Essentially, with recurring payments, the client agrees to make automatic payments at certain intervals for a certain amount of time, and the law firm then automatically receives regular payments following the agreed-upon schedule and terms.

As with other types of alternative payment methods, payment plans like recurring payments and subscriptions appear to be gaining traction in the legal industry—particularly with mid-sized law firms.

Specifically, as the 2023 Legal Trends for Mid-Sized Law Firms report outlines, 15% of mid-sized law firms (firms with 21 or more employees) offer monthly subscriptions as a payment option. In comparison, 5% of smaller law firms (with 20 or fewer employees) offer monthly subscriptions as a payment option.

Why should law firms offer recurring payments?

For many law firms, offering recurring payments can be an effective solution that gives clients more payment flexibility while improving law firm cash flow and saving firm time that would otherwise be lost chasing down payments.

Below, we’ll explore some of the potential benefits of offering recurring payments for your law firm:

Recurring payments can improve payment collections processes

As with other alternative payment methods, when you give clients more options for how and when they can pay via recurring billing, it’s easier and less stressful for them to pay—which means they’re more likely to pay their legal bills. When clients pay, your law firm brings in more revenue, and so does your firm’s cash flow.

Specifically, data from the 2023 Legal Trends Report offers insight into the impact that offering payment plans (which break legal bills down into multiple installments, just as recurring payments do) can have on law firm collection rates:

- For firms of all sizes studied in the report, the law firms that used payment plans collected 49% more monthly revenue per lawyer than firms that didn’t use payment plans.

- This revenue gap was even wider for solo law firms, with a total of 71% in increased monthly revenue for solos that offered payment plans to clients when compared to those that did not.

- Small and mid-sized law firms also saw big differences in collection rates, with 39% and 32%, respectively.

And, collecting faster sets you up to successfully keep your financials in order, making your year-end financials that much easier to manage.

Recurring payments can help clients access legal services

Paying for legal services outright isn’t possible for everyone. Some people may simply not have the means to easily pay a large bill in full, while others may struggle with the unexpected nature of their need for legal services. In many practice areas, for example, the need to access legal services often arises quite suddenly—such as when a client faces a divorce in family law, when they’re charged with a crime in criminal defense, or when their neighbor raises a dispute in civil litigation. For clients facing these types of challenges, recurring payments and other alternative payment options (such as legal fee financing) can be a difference maker.

While clients may not be able to pay for the legal services they need in one lump sum, breaking their payments into more manageable, ongoing installments can increase the affordability of their legal bills. This is where subscribing to recurring payments may help allow clients to access justice when they need it.

And, even if a client has the means to pay, they may prefer to use recurring payments (or, for a bill with a clear end amount, scheduled payments) for more flexibility when paying legal bills.

Recurring payments help law firms save time

From invoicing, communicating with clients regarding payment, and following up on outstanding payments, the payment collection process can be incredibly time-consuming for law firms.

By setting up an automatic recurring payment schedule with clients for ongoing work, you can improve efficiency and save time that you’d otherwise spend chasing down payments. And, if you use a tool like Clio Payments for accepting recurring payments, you can save more time by automating the follow-ups and administrative work.

Want to learn more about other ways that legal workflow automation can save your firm time? Our guide to legal workflow automation is a great place to start.

Note: Of course, when considering these benefits, it’s crucial to keep your law firm and clients’ specific needs in mind. It’s important to tailor the payment options that your firm offers to your situation. Depending on the type of services a firm provides, recurring payments may not be the best option for every law firm. For example, recurring payments likely won’t be a key offering for law firms that traditionally offer one-off services, like drafting wills.

You may like these posts

Setting up recurring payments in Clio

Using law practice management software like Clio is a great way to offer recurring payments to your clients with minimal effort.

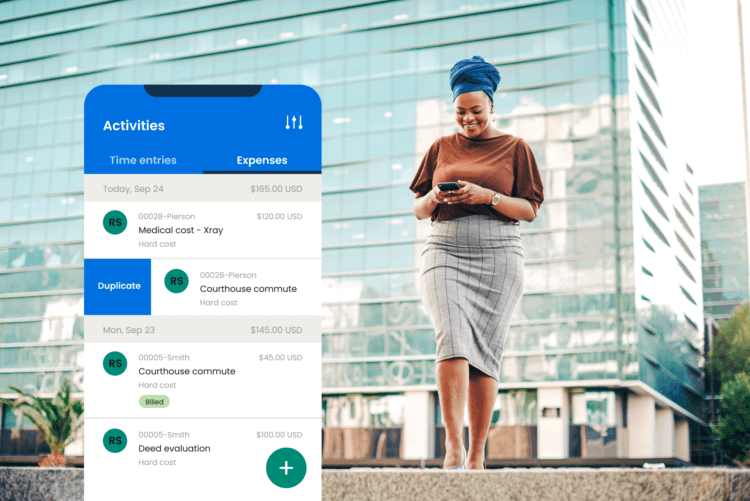

Recurring payments can be made possible for your clients in Clio Manage using the built-in set of payment collection features via Clio Payments.

With payment plans in Clio Payments for customers in the US, you can receive credit card, debit card, digital wallet, or eCheck payments toward your client’s outstanding balance, paid at specified intervals until their bill is paid in full.

In order to offer recurring payments, your firm must set up a payment plan and then choose the appropriate settings to allow for recurring payments. Here are the basic steps for setting up recurring payments in Clio:

- First, set up a payment plan for the client in Clio Payments (learn how here)

- Then, edit the payment plan parameters to allow for recurring or subscription-style payments, including:

- Payment frequency

- Installment amount

- Start date

- Total amount (Note: for a subscription or recurring payment, the total amount should be high enough to account for the ongoing nature of the payments.)

When creating any type of payment plan in Clio Payments, bear in mind the following important notes:

- Timing. You can only create a payment plan for each contact after a bill has been generated.

- Notifications. When you create the payment plan, your client will receive an email notification.

- Frequency. After the payment plan is active, it will begin debiting payment from the client’s chosen payment method at the interval you selected when the plan was created.

- Duration. The payment plan will then continue to debit payments (at the scheduled intervals) until the bill is either paid in full or until the plan is stopped manually.

Clio Payments makes it easy to set up recurring payments for your clients, so they can pay their bills in an amount and frequency that meets their needs and budget—while also making sure your firm gets paid.

And, because recurring payments in Clio Payments are automated, you don’t have to dedicate time to following up and chasing down payments. Instead, you can focus on delivering a great client experience and taking on meaningful legal work.

Of course, it’s important to first spend some time creating internal protocols and systems for recurring payments at your firm before you offer them as an option to clients. To learn more about how to implement payment plans at your law firm—including how to determine when to offer them, how to draft an agreement template, and how to set up a billing system—read our guide here.

Consider using recurring payments at your law firm today

By offering recurring payments, you can give your clients the flexibility to pay in manageable installments, while also ensuring your firm keeps cash flow steady. While recurring payments may not be a fit in every situation or for every firm, offering them as an alternative payment plan option can help improve prospective clients’ access to justice and legal services while streamlining your payment collection process and saving you time.

Recurring payments are also incredibly easy to set up with Clio Payments. In a few simple clicks, you can put your client’s agreed-upon payment plan into motion, and Clio will take care of the rest—all while keeping your client notified about their payments and their balance.

And, whether or not your clients choose the option of recurring payments, Clio Payments can help make their payment experience more convenient and simple—which benefits your clients and your firm.

Case in point? Tina Lyda Schaffer, Support Staff at Leh Law Group, LLC., attests to how Clio Payments makes payments easier for clients and the firm:

“Clio gives us the ability to offer payment options to our clients that allow them to process their payment without the need to contact our office. They can pay their bill with our firm, just like any other bill. It makes the process smooth.”

Curious about other ways that Clio Payments can streamline payments for your law firm? Visit our Clio Payments webpage to learn more.

We published this blog post in November 2023. Last updated: .

Categorized in: Accounting