If you’ve browsed an online shopping website recently, you’ve likely seen options to “buy now, pay later” or “pay in installments” from companies like Afterpay or Klarna.

It’s clear that scheduled payments are here to stay. So, why not offer the same option at your law firm?

While they may seem like a gimmick, scheduled payments are an excellent way for law firms to market their products and services while also providing a client-centered experience.

Below, we’ll dive into scheduled payments—outlining what they are and how they help clients. From there, we’ll discuss how easy it is to set up scheduled payments for your law firm with Clio Payments. We’ll round out our post with a list of the benefits of offering scheduled payments for law firms.

What are scheduled payments?

Scheduled payments—much like payment plans—are regular payments made on a recurring basis. With scheduled payments, law firms and their clients agree on an amount per payment and frequency, allowing clients to pay their bills in a way that suits their needs while ensuring that law firms get paid for their work.

Scheduled payments help clients

Scheduled payments can provide clarity and reliability for clients, regardless of their financial situation.

Not everyone has the means to pay for legal services outright. Or, perhaps, they may just want the convenience of paying in installments. Having the option to break bills into manageable installments can make a difference in deciding to hire a lawyer.

Scheduled payments don’t just increase accessibility for legal services—they also offer the flexible payment options that modern law firm clients are looking for. In a world where you can purchase anything from stationery to vehicles via scheduled payments, clients expect options.

At the heart of this discussion is focusing on your client’s needs. Whether they want scheduled payments or not, offering a variety of options is central to providing a client-centered experience that respects the variety and dignity of your clients’ needs and accommodates their interests in every aspect of your business.

How to set up scheduled payments for your law firm

While setting up scheduled payments might sound daunting, it’s easy with the right legal practice management software.

Clio can easily accommodate scheduled payments and other variable payment models, allowing your firm to provide clients with the right payment method for their lifestyle and budget. Amidst mounting inflation and rising interest rates, offering a little flexibility for clients can go a long way in creating a client-centered experience.

Setting up recurring payments using Clio

So, how do you set up scheduled payments in Clio? It’s easy!

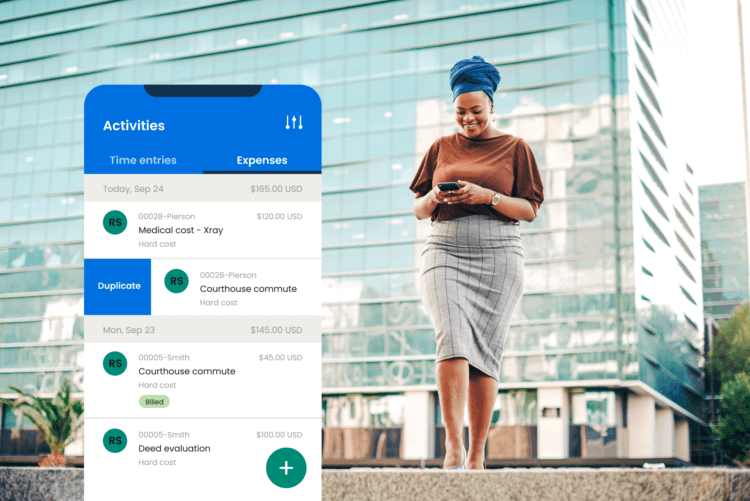

All you have to do is set up a payment plan in Clio Manage (via Clio Payments, Clio’s credit card and legal payments processing software).

You can set up a payment plan after creating a bill. When you create a payment plan, your client will receive an email. After the payment plan is active, it will begin debiting payment from the client’s chosen payment method on your chosen interval. It will continue to debit payment until the bill is paid in full or until the plan is stopped, making the scheduled payments process practically effortless.

But don’t just take our word for it—here’s what a client has to say about creating bills with Clio Payments:

“Sending a click-to-pay link to customers is genius – having the ability to collect payment without having to generate a bill is easy and I get paid faster.” – Anna Valiente Gomez, Attorney At Law.

You may like these posts

Benefits of scheduled payments for law firms

If the ease of setting up payment plans in Clio Manage doesn’t already have you excited to get started with scheduled payments, we’ve provided just a few of the benefits of scheduled payments for law firms below:

Get clients (and get paid faster!)

It’s well-established that online payments offer a more convenient payment experience for clients—while providing revenue advantages for law firms. The added flexibility of payment plans and scheduled payments gives clients even more transparency and control over their bills.

In any event, when it comes to paying legal bills, again, clients want options. Clio’s 2022 Legal Trends Report found that payment plans (including scheduled payments) are among the top factors clients consider when hiring a law firm, with multiple billing options receiving the fourth-highest impact score for law firm hireability.

As an added bonus, by making it easy for clients to pay their bills, law firms can reduce friction throughout the billing process, get paid faster, and even grow their revenue. Clio’s 2021 Legal Trends Report found that the firms who were most successful at growing their revenue were 37% more likely to be using online payments!

More flexibility for clients

Every client is different, and one client’s “no big deal” bill can be a challenging expense for another. By offering scheduled payments, you can open up opportunities for clients who may otherwise be unable to afford your services.

What’s more, scheduled payments can reduce the burden of managing finances and budgeting. Setting up a scheduled payment plan can help clients plan ahead and know exactly what payment amounts to plan for. This helps avoid concerns about following up on due dates and arranging payments.

Improved efficiency

We’ve all been there—spending countless hours tracking down clients for payment (or delegating this task to another employee). Thankfully, with scheduled payments, law firms can increase efficiency by crossing “follow-up with a client regarding their outstanding bill” off their to-do list. By setting up automatic payments, law firms can automate their payment process. This minimizes the need for manual invoicing and reduces the time they’d otherwise spend on collections.

Want to explore more resources on payments? Be sure to check out our resource hub, Payments for Lawyers.

Final notes on scheduled payments

Offering scheduled payments at your law firm helps lawyers help clients—while also ensuring that you get paid. Indeed, by taking the guesswork out of payments (and the stress out of paying a lump sum bill), lawyers can spend more time focusing on meaningful legal work and less time chasing down payment.

With Clio Payments, setting up scheduled payments couldn’t be easier. So, what are you waiting for? Start giving your clients the experience they want by incorporating alternative payment methods into your law firm’s billing process.

And, if you’re eager for more client-centered insights, be sure to check out The Client-Centered Law Firm to learn how to thrive as a lawyer in today’s world (the first chapter is on us!).

What happens when you schedule a payment?

When you schedule a payment, you are setting up payment amounts to be withdrawn at specific times. Once payment is scheduled, the payment system will automatically withdraw scheduled payments, making it simple to keep track of your payments and avoid errors.

What is scheduled vs. recurring payments?

Scheduled payment and recurring payments are often used interchangeably. For both types of payments, the payor will make automatic payments towards a bill in installments at set intervals and in set amounts until the balance is paid in full.

We published this blog post in April 2023. Last updated: .

Categorized in: Accounting