A better payment experience for you and your clients

-

Debit card and credit card, Apple Pay and Google Pay, and Pay by Bank payment processing

Regulation-compliant client accounting

Automated payment plans

Clear, transparent pricing with no monthly subscription costs

Manage billing and payments while offering more ways to pay

-

Get more out of Clio’s billing features

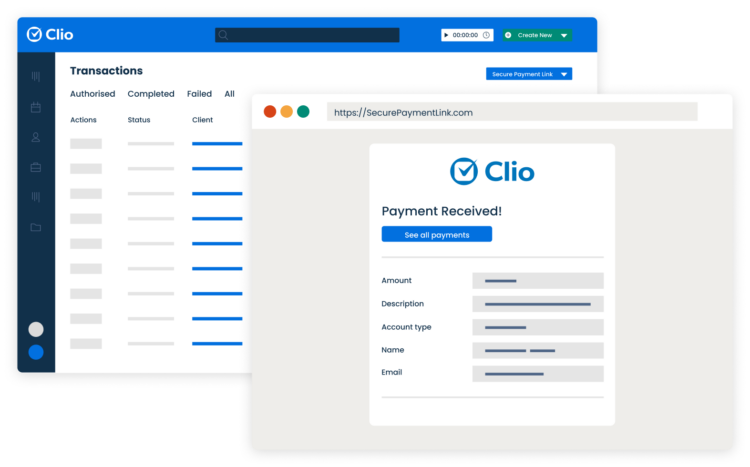

Generate bills, get paid, and let Clio update your payment records automatically. Clio records each transaction and syncs the information to your accounting platform, saving you time and reducing the risk of error.

-

Multiple ways to pay

Make it easy for clients to pay with a wide selection of payment options. Accept Pay by Bank, debit and credit card payments, Apple Pay and Google Pay through your website, click-to-pay links, or QR codes—providing your clients the convenience to pay how they prefer.

-

Flexible payment plans

Collect more of your outstanding balances and give your clients more flexibility. Use customised payment plans to break large bills into manageable amounts on a schedule that fits their needs.

A legal payments solution your firm can trust

-

Industry-compliant trust accounting

Clio handles all client-related transactions in compliance with SRA regulations. With earned and unearned funds kept separate, funds in your client account are protected from all third-party debiting, including processing fees and chargebacks.

-

Secure PCI compliant payments

Clio uses the payment industry’s most advanced security measures—with bank-grade protection of your client’s data and proactive fraud detection—so you can safely accept online payments and store card details for future transactions.

-

Real-time insights into your finances

Stay on top of all your transactions with financial reports and instant payment notifications to get a real-time view of any outstanding balances. Create automated payment reminders for any bills that need additional follow-up.

Simple, transparent pricing with no hidden fees

Clio

vs.

Third Party Processors

Third Party Processors

Blank

1.85% + £0.20 for Standard Visa and Mastercard cards 3.45% + £0.20 for Specialty and International cards

Debit & credit card transaction fees

Blank

Up to 3.45% + fixed fee. Fees vary by card type

Blank

0% per transaction

Bank transfer fees

Blank

Up to 1% with a monthly subscription. Fees vary

Blank

No fees

Card network fees

Blank

Fees vary by transaction and card type

Blank

No fees

Other fees

Blank

Fees vary (Monthly memberships, PCI compliance, and more)

Clio

vs.

Third Party Processors

Third Party Processors

Blank

1.85% + £0.20 for Standard Visa and Mastercard cards 3.45% + £0.20 for Specialty and International cards

Debit & credit card transaction fees

Blank

Up to 3.45% + fixed fee. Fees vary by card type

Blank

0% per transaction

Bank transfer fees

Blank

Up to 1% with a monthly subscription. Fees vary

Blank

No fees

Card network fees

Blank

Fees vary by transaction and card type

Blank

No fees

Other fees

Blank

Fees vary (Monthly memberships, PCI compliance, and more)

Start accepting payments in seconds

Enabling payments is fast and easy—with instantaneous approval for most firms.

Frequently Asked Questions

What information is required to set up payments in Clio Manage?

To set up payments in Clio Manage from a UK Clio account, you’ll need the following information:

- Bank account number for the account you wish to receive payments into

- Sort code

- VAT number (if applicable)

- Company number (if applicable).

Where is it available?

At this time, Clio Payments is available to customers in the UK, the U.S., and Canada.

What is Clio’s advanced chargeback guarantee?

Credit card disputes happen, and if and when they do, Clio has you covered. Chargebacks are fees charged by banks when a client disputes a charge, but rest assured that a credit card chargeback will never be taken from your client account. If a chargeback occurs you will be alerted and our team can walk you through the dispute process without any need to share private information. Our dispute resolution process is seamless, automated, and self-serve in order to protect law firm and client confidentiality.