When I first started my law firm, I asked the attorneys I knew how they dealt with clients who wanted to pay by credit card.

The unanimous answer? Not one of them accepted credit cards as a payment method.

This was in 2015.

Fast forward several years: Most clients now expect to pay legal fees or retainers by credit card.

Technology is changing how people pay for things, and your clients have become accustomed to the ease that credit cards offer. As a result, they use them for nearly all daily transactions, bills, and services—including legal services.

In this blog post, we’ll explore:

- Why clients want to pay by credit card

- How you can make credit cards one of your lawyer payment methods

- Tips and tools that can help your law firm get paid quickly through credit card.

Legal clients want to pay by credit card

Your legal clients not only want to pay by credit card—they expect to.

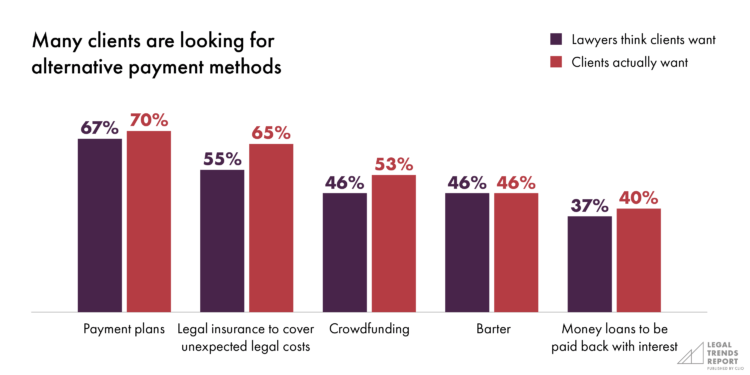

The 2021 Legal Trends Report found that consumers ranked whether a law firm offered payment plans as one of the most important factors for hiring a law firm.

That’s because we live in an age where:

- There are plenty of options for alternative delivery of legal services.

- Clients have come to expect the instant service and satisfaction they get from Amazon, Netflix, and Uber in every consumer interaction.

The bottom line is: Your clients have expectations for who they do business with and they are short on time. They want flexibility, convenience, and ease.

When your law firm is thoughtful, responsive, and engaged with what your clients want, you not only make it easier for clients to pay, you experience benefits like getting paid faster, improving collections, setting yourselves apart from the competition, and more.

And if those payments are made online? Even better. According to the 2022 Legal Trends Report, law firms that increased their revenue year-over-year were much more likely to use online payment processing systems.

Credit card payments put your clients first

For most people, coming up with a $10,000 retainer isn’t easy. Even if they have the funds, their money may be tied up in an investment or retirement account.

What’s more, potential clients are now also struggling with the burdens of inflation.

Asking clients to pay for significant retainers upfront, plus additional replenishments as the case progresses, could result in your clients either opting to handle legal issues on their own or hire a more affordable lawyer should rates increase.

That’s where payment plans via credit card come into play.

According to the 2022 Legal Trends Report, 70% of consumers want the option to pay a lawyer via a payment plan. Doing so allows your legal clients to pay via automated payments or fund transfers—giving your firm a competitive edge.

Because of liquidity constraints, clients appreciate the option to break that retainer up into multiple payments. As credit cards allow them to make automatic payments to your firm, they are a central part of payment plans.

Payment plans via credit card payments can benefit your law firm, too.

That’s because automated payments mean you no longer have to manually collect outstanding bills every month—which can be time-consuming.

This is also why so many law firms are turning to online payment solutions to help make it easy to collect payments.

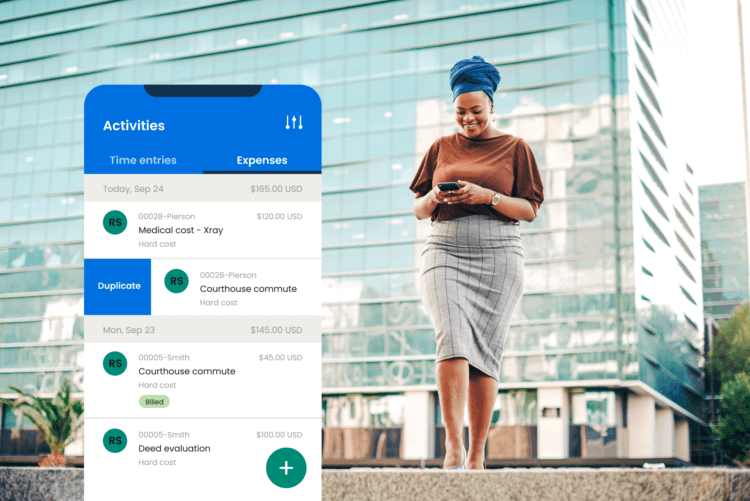

For instance, online payment solutions, like Clio, make it easy to automatically replenish retainers or break up payments for fixed fee services.

You can accept credit, debit, and eCheck payments online, and your clients can pay through flexible payment plans, accept trust payments, and be confident that you are compliant with trust accounting rules.

This ultimately allows you to spend more of your precious time practicing the law.

You may like these posts

Credit card payments can help you get paid faster

Let’s face it: Traditional payment transactions via cash or check can be a tedious process.

- To pay by check, clients typically have to manually write out a check, go to the post office to mail it, and then your law firm has to deposit it. And in many cases, your clients may not even have checkbooks.

- To pay with cash, you need to meet your clients face-to-face, and then deposit the cash at the bank. These days, a lot of people don’t carry cash with them.

In our digitized, 21st century, these options are not exactly convenient. Both of these instances require your clients to visit the bank first to order a checkbook or take out cash, adding to the time needed to complete the transaction.

What’s more, in certain situations like a pandemic, or for clients who can’t visit your law office, it may also be difficult to arrange an in-person appointment just so your client can pay your law firm.

With credit cards as one of your lawyer payment methods, you can complete the transaction online and even set up automatic payments.

When your law firm accepts credit cards, you:

- Save valuable time otherwise spent tracking down payments and processing checks.

- Receive payments sooner.

- Reduce the time between the client making a payment and your firm receiving it.

Learn about setting up payment plans with Clio.

Considerations before accepting credit cards

So, we’ve established that your clients want to pay by credit card and that your firm will see many benefits by integrating them into your practice. But before implementing this payment option, you need to understand the ethics of law firms accepting credit card payments.

There are four ethical questions when it comes to accepting credit cards at a law firm:

- Can I accept payment for legal fees and expenses with a credit card?

- Can I accept the advance payment of fees via a credit card?

- Can I pass a surcharge to my client to compensate for the processing fees charged by some credit card processors?

- Can I set up recurring charges for customers once they have stored a credit card on file with my law firm?

As always, different jurisdictions have different ethics rules regarding lawyers accepting credit card payments. While lawyers can take credit card payments (especially since clients want to pay by credit card), remember to check your state for specific rules regarding firms accepting credit cards.

Learn more about the ethics of law firms accepting credit card payments.

How to let clients pay by credit card

If you’re ready to accept credit cards, one of the first steps is to decide how you’ll accept credit card payments.

Below are the different ways your law firm can accept credit cards.

Different ways of accepting credit card payments from law firm clients

Online credit card payments

One of the easiest ways to meet the needs of clients who want to pay with a credit card is to accept online credit card payments.

And the good news is that setting up online payments is easy: You just need to provide a payment gateway, a technology that allows you to accept debit or credit card purchases from your clients.

It’s best to find a native payment processor that is specific to the legal industry. That’s because, due to ethics rules, selecting a credit card processing provider involves an extra layer of complexity: you need a credit card processing solution that recognizes and accounts for the difference between trust accounts (for retainers) and operating accounts (for bill payments).

When deciding which online legal payments provider to go with, make sure that the solution you choose can:

- Schedule recurring credit card payment plans.

- Follows trust accounting ethics and is PCI compliant.

- Arrange automatic top-ups for trust accounts.

- Integrate into your firm’s workflow.

While there are many available online credit card payment providers, it can be overwhelming to know which one to go with. That’s why we’ve put together a guide to choosing the best credit card processing service for lawyers.

In-person credit card payments

Although this is another way your law firm can accept credit card payments, it’s a more time-consuming method. It’s also a less client-centered option for accepting payments.

However, for certain clients who can’t access a mobile device or computer to complete their online credit card payment, your law firm can consider accepting in-person credit card payments.

Some ways of accepting in-person credit card payments include using a payment services provider like Square or Stripe.

Want more information on payment processing for law firms? Our guide, Everything you Need to Know About Legal Payment Processing Solutions has it all covered.

Merchant bank accounts

Opening a merchant bank account to accept credit card payments from your legal clients is another way you can accept credit card payments.

That said, a credit card processing service and legal payments provider like Clio Payments typically charges lower processing and transaction fees.

For more tips on credit cards and online payments for lawyers, visit our payments resource hub.

Tips for getting paid quickly

We’ve established that legal clients want to pay by credit card and that your law firm can benefit from accepting credit card payments.

What are some other ways you can get paid quickly and improve your firm’s cash flow? We’ve put together a more in-depth guide in our law firm billing guide, but the main ways to make sure you get paid quickly are to:

- Improve your timekeeping and record-keeping habits so you can accurately collect billed time.

- Bill consistently so clients know when they can expect to pay your law firm.

- Send clients regular billing reminders.

- Have the option of split billing to allow for multiple payers.

- Accept credit card payments—since clients want to pay by credit card and there are many benefits to letting them do so.

The bottom line is: when you client can pay online, you have the ability to manage the entire legal client journey—from the very beginning of client intake, all the way through payment collection. And when you can do that through one secure, compliant, and trusted system, you get paid faster.

Reap the rewards of letting clients pay by credit card

One of the primary reasons your clients want to pay by credit card is they’re already used to doing so for other purchases and services—and for good reason.

Your law firm benefits, too. That’s because accepting credit card payments can also help your firm improve cash flow, get paid faster, and provide better client-centered service. All of this can increase your bottom line.

However, there are some ethical considerations before you choose a credit card processing service. Be sure to check your jurisdiction’s rules and recommendations surrounding law firms accepting credit cards, before choosing a credit card processing service.

Want more? We cover 5 ways you can start accepting credit cards at your law firm.

We published this blog post in October 2018. Last updated: .

Categorized in: Business

Get paid faster, save time, and reduce outstanding bills

Download our free e-book and learn the 7 easy steps to easier, more efficent billing

Get the e-book